Tax-Free Childcare: Paid work

The claimant and their partner must both be in qualifying paid work on the date of declaration (or reconfirmation).

- National insurance number requirement

- What is paid work?

- Employed claimants

- Self-employed claimants

- Employment and self-employment

- Expected income vs. hours

- What counts as employed income?

- What counts as self-employed income?

- Treated as in qualifying paid work

National insurance number requirement

Both the claimant, and their partner if they have one, must hold a National Insurance Number. The only exception to this is if the claimant's partner is resident and in paid work in a prescribed state (any EEA State or Switzerland).

Paid work means work done for payment or in expectation of payment and does not include being engaged by a charitable or voluntary organisation, or as a volunteer, in circumstances where the only payment made is in respect of expenses.

Employment for TFC means 'engaged under a contract of service or in an office (including an elected office) or so engaged as a UK resident working overseas'. Where someone has accepted an offer of work on or before their declaration of eligibility they are treated as in paid work as an employed person during the applicable period set out below. Similarly, where a person is on unpaid leave from work when they make their declaration but they intend to return to work, they will still be treated as in paid work as an employed person during the applicable period set out below.

Applicable periods

The applicable period was introduced from 15 September 2025, in relation to expected work start dates which fall on or after 16th October 2025, to align the rules for tax-free childcare with the rules for free childcare for working parents. Before this change, the rules above applied where a person accepted an offer of work and expected to start within 31 days of the declaration date or where they were absent from work but expected to return within 31 days of the declaration date.

Due to the change, transitional provisions allow for an alternative applicable period where the expected work start date falls in the period between 16 October 2025 and 31 January 2026, the applicable period is 15 September 2025 and ends the day before the person starts or returns to work.

Otherwise, the applicable periods are as follows:

The applicable period is based on the claimant’s expected work start date at the time they make the declaration of eligibility:

- Expected work start date falls between 1st February and 30 April (inclusive), applicable period begins 1st January preceding the expected work start date and ends the day before the person starts or returns to work;

- Expected work start date falls between 1 May and 30 September (inclusive), applicable period begins 1 April and ends the day before the person starts or returns to work;

- Expected work start date falls between 1 October and 31 January (inclusive), applicable period begins 1 September and ends the day before the person starts or returns to work

If the person is employed they will be treated as in qualifying paid work if their expected income for the specified period (which starts from the date they make their declaration or reconfirmation) to be equal to or above the relevant threshold. If on unpaid leave from work, this will be 3 months from the date of return and if about to start work, 3 months from the date of commencement.

Note that this test is based on expected income, not actual income.

For most people aged 21 over, the threshold will be £2,539.68 per 3 month entitlement period (if it contains 13 weeks) from 1 April 2025.

The specified period is:

a) 3 months beginning with the date of the declaration of eligibility

b) Where the person has accepted an offer of work and expects to start within 31 days of the declaration date - 3 months beginning with the day on which the work is expected to start

c) Where the person is absent from work on unpaid leave and expects to return to work within 31 days of the declaration date - 3 months beginning with the day on which the person is expected to return to work.

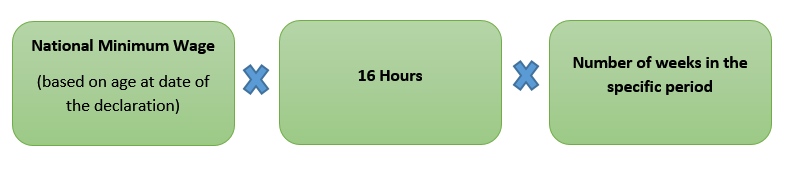

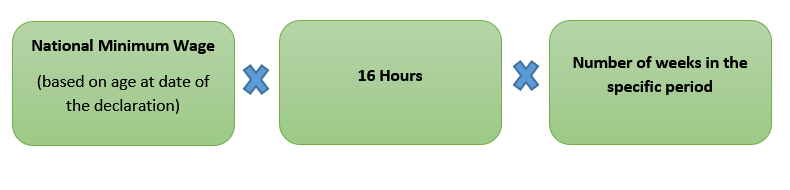

The relevant threshold is:

The current NMW rates can be found on GOV.UK.

Example 1

Daisha (age 30) and Peter (age 29) are married and have two children. Daisha makes her declaration of eligibility on 30 April 2025. Peter works full time (35 hours a week). Daisha works 30 hours a week but from 18 June, Daisha expects to reduce her hours to 10 a week. Peter's relevant threshold for the entitlement period is £12.21 x 16 hours = £195.36 x 13 weeks = £2,539.68. His income is expected to exceed his threshold and so he is in qualifying paid work.

Daisha's relevant threshold is also £2,539.68. Daisha calculates her expected income for the period as ((30 x £12.21 x 7 weeks= £2,564.10) + (10 x £11.44 x 6 weeks= £732.60)) = £3,296.70. The fact that Daisha works only 10 hours a week in the last 6 weeks of the entitlement period is irrelevant. Of course, if she continues to only work 10 hours a week and expects to do so for the following entitlement period, she will not be in qualifying paid work when she reconfirms her eligibility.

Example 2

Assume that Daisha from Example 1 actually worked 18 hours for 7 weeks and then 10 hours for 6 weeks - her expected income for the period would be £2,271.06. This means Daisha would not meet the qualifying work requirement and therefore the couple will not be entitled to TFC top-up payments

In most cases, employees will receive income for work done during the relevant 3 month period in that 3 month period. HMRC say that expected income must relate to work done in the period concerned but can still be accepted if it is paid to the employee outside of this period. An example is given in the TCM manual of a Limited Company director who pays his salary annually.

Expected income must be earned in the specified period beginning with the date of declaration of eligibility. Generally, if someone only works part of the year, they will only be eligible for TFC when they are expecting to work and earn the minimum income requirement across the specified period on average. This can be problematic for claimants who are term time workers but who are paid over the year. HMRC’s TFC manual suggests that a term time worker paid over the whole year, earning less than 16 hours x NMW when paid across the whole year, can use their expected earnings based on the hours they actually work in term time to qualify for TFC. See the example of Jim in the TFC manual

Self-employed for TFC purposes means 'engaged in carrying on a trade, profession or vocation on a commercial basis and with a view to profit, either on one's own account or as a member of a business partnership. This definition is different to both tax credits and universal credit.

Self-employed claimants do not have to meet the earnings thresholds in respect of their first declaration of eligibility if it is made within a start-up period or in declarations of eligibility in each of the three entitlement periods immediately following that start up period.

A start up period is the period of 12 months from the commencement of the trade, profession or vocation. Only one start-up period is allowed every five years.

If the person is self-employed they will only be treated as in qualifying paid work if their expected income from paid work for the specified period (which starts from the date they make the declaration of reconfirmation) to be equal to or above the relevant threshold.

For self-employed people this means their threshold will be either £2,539.68(based on a 3 month/13 week period from 1 April 2025) or £10,158.72 (based on a 12 month period - see below).

The relevant threshold is:

The current NMW rates can be found on GOV.UK.

Self-employed claimants have a second opportunity to meet the qualifying paid work requirement. This was introduced because using the normal test explained above, self-employed claimants who have fluctuating incomes, might not qualify when looking only at a three-month entitlement period but would do if you look at their annual income.

If they do not qualify under the normal test above - looking at their expected earnings over a three month period - then they can qualify if they expect their income for the tax year (12 months) in which the date of declaration falls to be greater than the relevant threshold.

Relevant threshold when using a 12 month (tax year) expected income (rather than 3 months) has a slightly different definition when setting what rate of NMW to use.

Example 1

Mark is a self-employed single parent (age 27). He makes a declaration of eligibility on 30 April 2025. As this is in the 2025/26 tax year, the NMW rate of £12.21 applies. His relevant threshold will be £12.21 x 16 hours = £195.36 x 52 weeks = £10,158.72.

Mark will be in qualifying paid work if he expects his income from self-employment to be £10,158.72 or more in the 2025/26 tax year.

Example 2

Denise is a self-employed single parent. She runs her own business as a wedding photographer - she is very busy during the summer months (averaging 8 - 10 weddings each month) with only 1 or 2 each month in the winter.

Denise applies for TFC on 30 April 2025. Under the standard test (explained above) Denise's relevant threshold for the entitlement period (3 months from 30 April 2025) is £12.21 x 16 hours = £195.36 x 13 weeks = £2,539.68. However, due to a low volume of work over the winter, Denise only expects her income from self-employment to be £1200 for the entitlement period.

However, Denise can also be classed as in qualifying paid work if her self-employed income for 2025/26 will be at least £10,158.72 As Denise has a busy summer, she expects her annual income to be £12,000. Therefore she meets the test and will be in qualifying paid work for that first entitlement period starting on 30 April 2025.

Employment and self-employment

Some people may be both employed and self-employed. Where that is the case, the first thing to establish is whether they can meet the tests set out above through either their employed income alone or their self-employed income alone.

If they cannot, then they can combine the earnings from both over the 3 months beginning with the date of declaration of eligibility (or, where appropriate, the 3 months beginning with the day on which the work is expected to start of the person is expected to return to work). It should be noted that the rules explained above that allow self-employed claimants to consider their income over 12 months in order to qualify does not apply when combining employment and self-employment. In those cases, only self-employed income can be used to meet the 12 month requirement.

TFC does not work using actual income figures and there is no end of year reconciliation exercise like there is in the tax credits system. Instead, TFC asks people to forecast their expected income for the next 3 months in most cases (12 for some self-employed people).

So what does expected mean? The Regulations simply say it is the income which the person has a reasonable expectation of receiving.

HMRC have published some information about reasonable expectations in their guidance. See page 20 and 21 of the guide for parents. However, the examples cover more straightforward situations.

It is not yet known how HMRC will police this, whether it will be subject to compliance checks and whether there will be any challenge to the 'reasonable expectation'.

What is clear is that if the person's actual income for the period turns out to be less than their threshold, HMRC cannot reclaim the TFC top-up automatically - they could only do so if they could show that the person's estimate of their expected income was not reasonable.

What counts as employed income?

Any earnings that a person receives from any employment under a contract of service of any office, including an elected office, counts towards the threshold.

It is gross income that counts for TFC purposes - before any deductions for tax, national insurance or pension contributions.

Earnings are given the same meaning as in Section 62 ITEPA 2003. This includes:

- Any salary, wages or fee

- Any gratuity or other profit or benefit of any kind obtained by the employee if it is money or money's worth

- Anything else that constitutes an emolument of the employment

The last two bullet points ensure that all money payments that are similar to earnings are included - that includes bonuses, commissions, tips, overtime pay. It also includes non-cash earnings such as benefits in kind, for example, a company car or medical insurance.

What counts as self-employed income?

Self-employed income unfortunately doesn't follow the tax system. It is calculated as:

(Amount of receipts) - (amount of expenses)

Receipts are those the person expects to derive from their trade, profession or vocation and expenses are those they expect to incur wholly and exclusively for the purposes of that trade, profession or vocation. The term wholly and exclusively will take its normal tax meaning.

It is gross income that counts - before deductions of tax, national insurance and pension contributions.

If they are in partnership, then it is their share of the receipts less their share of the expenses.

Importantly, in calculating a self-employed person’s income, receipts and expenses of a capital nature are to be disregarded. This means that for anyone using the cash basis, they will need to add back in to their income any capital purchase that they included as an expense for tax purposes. So for example, if they bought a laptop that they needed wholly and exclusively for their graphic design business and they deducted that as an expense for tax purposes under the cash basis, they do not include it as an expense when calculating whether they meet the TFC threshold. This is helpful for self-employed parents who need to buy capital items as it means they don’t lose their entitlement to TFC (assuming their income is otherwise above the threshold).

The HMRC TFC manual states that there is no definition of ‘capital’ so it takes its every day meaning – which means items of significant value that are used in the business over a number of years and are normally depreciated and not set wholly against profit in the year that they were bought. Under the cash basis, some capital items can be deducted as an expense against profit in the year they were bought.

Treated as in qualifying paid work

Periods of sickness or parental leave

Some people can be treated as in qualifying paid work even if they are not working. This means they are treated as in paid work and as having income equal to the earnings threshold.

In order for this to apply, the person must have been in qualifying paid work (or treated as if they were) immediately before the period they are:

- Paid statutory sick pay

- Paid maternity allowance

- Paid statutory maternity pay

- On ordinary or additional maternity leave

- Paid statutory paternity pay

- Paid statutory adoption pay

- On ordinary or additional adoption leave

- On shared paternal leave

- On statutory parental bereavement leave

- Paid statutory parental bereavement pay

- on statutory neonatal care leave (England, Scotland and Wales only)

- Paid statutory neonatal care pay

Where a claimant, or their partner, are claiming TFC in respect of a child whose birth or adoption cause the period of leave, they will only be treated as in qualifying paid work for the last 31 days before they return to work. However, they would be treated as in paid work for the whole period of leave in respect of any other children they are claiming TFC for.

Self-employed claimants are also treated as in qualifying paid work during any period for which any of the bullet points above would have applied but for the fact that the work they did immediately before the period of leave was self-employment rather than employed under a contract of service.

Residents of prescribed states (EEA countries or Switzerland) who are in paid work in the UK who receive payments similar to those in the bullet points above or who are on similar periods of leave under the law of their own country are also treated as in qualifying paid work.

Couples where one person can't work

Where one member of a couple is in qualifying paid work and the other is paid or entitled to:

- Incapacity benefit

- Severe disablement allowance

- Long term incapacity benefit

- Carer's allowance

- Contributory employment and support allowance

- National insurance credits on the grounds of incapacity for work or limited capacity for work

- Carer’s assistance paid under (Social Security (Scotland ) Act (except young carer grants)

The non-working member of the couple will be treated as in paid work so that they qualify for TFC.

For this exception to apply, there must be one member of the couple who is in qualifying paid work by meeting the relevant earnings threshold.

Example

Zoisha and David have three children. Zoisha works 35 hours a week. David does not work as he is a full-time carer for his disabled mother. Even though David is not working and does not earn above the relevant threshold, he is treated as in paid work and so the couple can claim TFC support.

Note that there is a requirement for at least one member of the couple to meet the earnings threshold at all times.

Assume that Zoisha and David claim TFC, they are entitled to support for the first three month entitlement period because Zoisha is in qualifying paid work as she meets the earning threshold and David is treated as in qualifying paid work because he is entitled to carer's allowance.

The couple will be expected to reconfirm their eligibility for TFC for the next three month entitlement period. Zoisha has given up work because her own mother is ill and she has also claimed carer's allowance. The couple will no longer qualify for TFC because neither of them is in qualifying paid work by virtue of meeting the earnings threshold.

Self-employed claimants are also treated as in qualifying paid work during any period for which any of the bullet points above would have applied, but for the fact that the work they did immediately before the period of leave was self-employment rather than employed under a contract of service.

Residents of prescribed states (EEA countries or Switzerland) who are in paid work in the UK who receive payments similar to those in the bullet points above under the law of their own country are also treated as in qualifying paid work.

Last reviewed/updated 16 September 2025